Refugee Medical Insurance (REMEDI)

What is REMEDI – Refugee Medical Insurance?

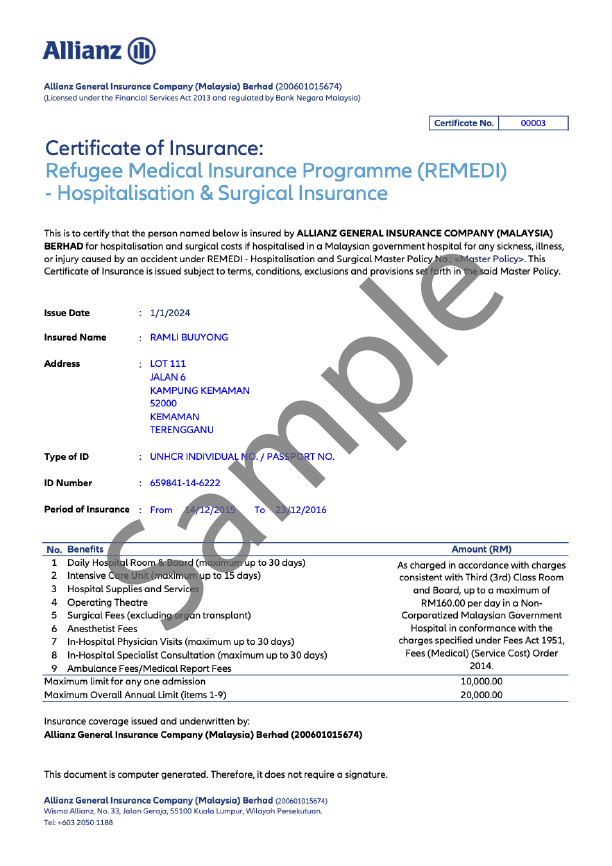

Refugee Medical Insurance (REMEDI) helps refugees with medical and accident-related costs . By enrolling in REMEDI, which costs RM 183.60 per year, REMEDI provides coverage if a refugee is admitted at a government hospital in Malaysia due to unexpected illnesses or accidents, or if they experience permanent disablement or medical expenses from an accident. If that happens, REMEDI will pay the full cost of the hospital bill up to RM 10,000 per admission and up to a total of RM 20,000 per year.

Why Should You Enrol?

- Unexpected injuries or illnesses can lead to costly hospital bills for refugees in Malaysia, risking their savings and financial stability

- REMEDI provides refugees peace of mind by covering hospital bills, so refugees don’t have to worry about unexpected medical expenses

- The annual cost to enrol in REMEDI – called the “premium” – is affordable compared to the coverage provided, which is up to RM10,000 per admission and RM20,000 annually for hospitalization and surgical expenses and RM10,000 for death or permanent disablement due to accidental causes. This means you are protected against unforeseen medical emergencies for as low as RM0.50 per day!

- REMEDI is the only insurance scheme in Malaysia endorsed by UNHCR, developed in partnership with Allianz

Who Can Enrol?

- Refugees and asylum-seekers registered with UNHCR in Malaysia

- Aged from eighteen (18) to sixty (60) years old

What is Covered Under REMEDI?

REMEDI covers hospital bills if you are admitted to a government hospital in Malaysia for unexpected illnesses or accidents.

What is Not Covered Under REMEDI?

REMEDI does not cover hospital bills at private hospitals, or outpatient treatments that do not require hospitalization.

In Malaysia, most medical insurance plans, including REMEDI, exclude coverage for certain conditions and treatments. These exclusions include:

- Pre-existing illness (an illness which existed before you enrolled in REMEDI and for which you have been aware of);

- Cardiovascular disease and all cancers, occurring within the first 120 days of your Period of Insurance;

- Plastic/cosmetic surgery, circumcision, eye examination, glasses, the use or acquisition of external prosthetic appliances or devices such as artificial limbs, hearing aids, implanted pacemakers and prescriptions;

- Dental conditions including dental treatment or oral surgery except as necessitated by Injury to sound natural teeth occurring wholly during your Period of Insurance;

- Private nursing, rest cures or sanitaria care, illegal drugs, intoxication, sterilization, venereal disease and its sequelae, AIDS (Acquired Immunodeficiency Syndrome), ARC (AIDS Related Complex), HIV (Human Immunodeficiency Virus) related diseases, and any communicable diseases requiring quarantine by law;

- Any treatment or surgical operation for Congenital Conditions/abnormalities or deformities including hereditary conditions;

- Childbirth, miscarriage or any complications to a pregnancy, unless caused solely and directly by an Accident and prenatal or postnatal care and surgical, mechanical or chemical contraceptive methods of birth control or treatment pertaining to infertility. Erectile dysfunction and tests or treatment related to impotence or sterilization;

- Insanity, suicide or any attempt thereat, or intentional self-inflicted injuries;

- War or any act of war, declared or undeclared, criminal or terrorist activities, active duty in any armed forces, direct participation in strikes, riots and civil commotion or insurrection;

- Psychotic, mental, or nervous disorders (including any neuroses and their physiological or psychosomatic manifestations).

Note: This list is non-exhaustive. Please refer to the policy for the full list of exclusions under this policy.

How to Enrol

To enroll in REMEDI, simply follow these steps:

Choose One (1) of the Options Below

a) Enrolment Events: Subscribe to the Refugee Malaysia Telegram channel for updates on upcoming events near you

b) Community Organisation: Ask your community leader about enrolment at community centres

c) Online Form: Provide your contact details to Allianz by completing this online form.

Wait

Wait for an Allianz agent to contact you.

Terms and Conditions

Consult with the Allianz agent to discuss the policy coverage, terms, and conditions.

Payment

If you are ready to enrol, make the payment of RM183.60 to the Allianz agent

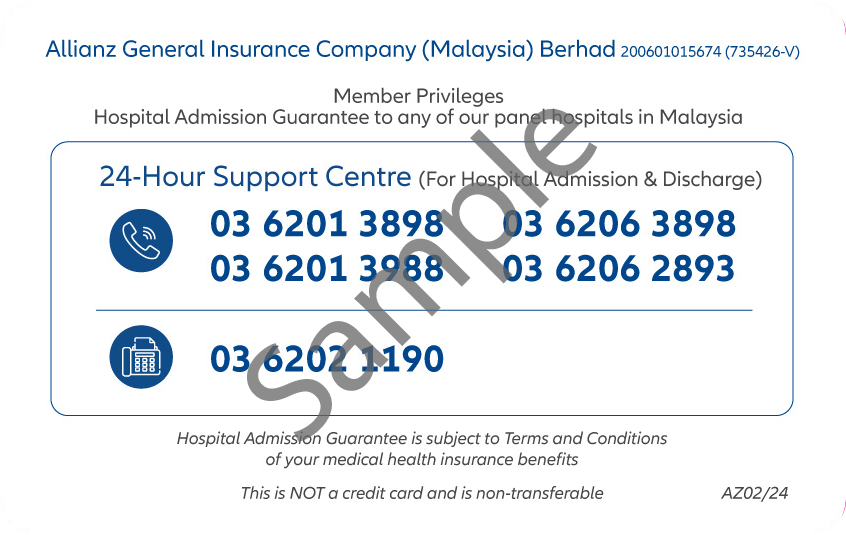

REMEDI Card

Collect your REMEDI card and Certificate of Insurance from the Allianz agent

REMEDI Documents

Once you have paid RM 183.60 to the Allianz agent and enrolled in REMEDI, you will receive the three documents below. You can also view the full list of REMEDI Documents including flyers, policy wording, and product disclosure sheet on Allianz’s website.

Medical Card (front)

Medical Card (back)

Cover Letter

Certificate of Insurance

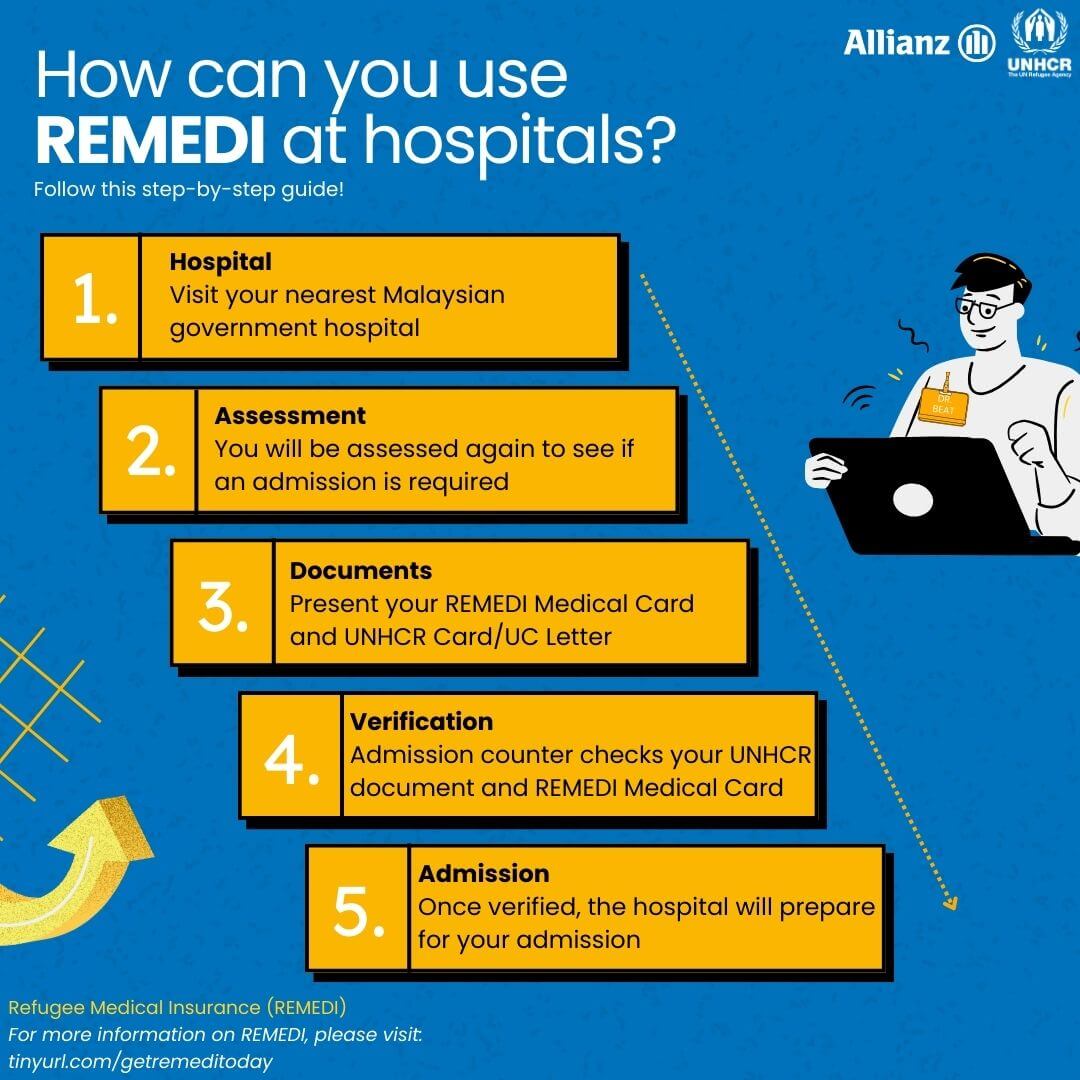

How Do I Use REMEDI at Hospitals?

Hospital

Visit your nearest Malaysian government hospital

Assessment

You will be assessed again to see if an admission is required

Documents

Present your REMEDI Medical Card and UNHCR Card/UC Letter

Verification

Admission counter checks patient’s UNHCR document & REMEDI Medical Card

Admission

Once verified, hospital will prepare for your admission

Recovery

Upon recovery, you will be informed of your discharge from hospital

Bill

Hospital prepares medical bill

Payment

If there are no uncovered items / treatment does not exceed your limits, no payment will be needed (otherwise clear all payments at the hospital).

Note: If there are charges not covered by the insurance, you are responsible for paying them. If you have difficulties in paying, you can contact the Malaysian Relief Agency. Medical assistance will be assessed on a case-by-case basis.

Medication

Collect all medication and medical certificate (MC) and get well soon!

REMEDI Related Materials

REMEDI

Have Some Questions?

For more information, please consult the Refugee Medical Insurance (REMEDI) Frequently Asked Questions (FAQ).